Aerospace Insights Elearning

Skip available courses

Available courses

Purpose

The purpose of the course is to enable learners understand the role of air traffic control in the management of aircraft movement under the various categories of airspace.

Course Content

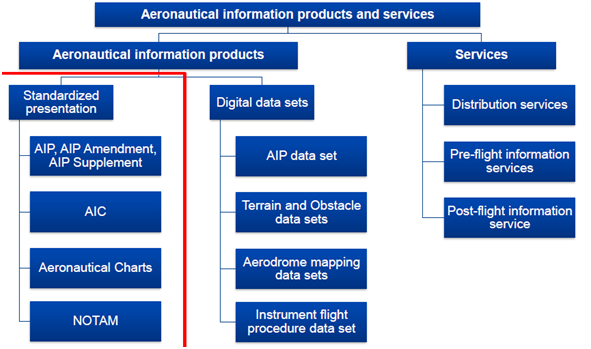

The development of air traffic management; Legal aspects and importance of ATC; Fundamental control tower operations, positions, responsibilities and equipment; Aircraft separation; Airport traffic patterns; Aircraft recognition; Definition and quantification of risk; Development of efficient procedures; Air traffic flow management; Aircraft loading; Role of ATC in accident investigation; Emergency response to aviation incidents and accidents; Aero-met; Aeronautical information services.

Course Reference

Daniel Odido (2021). The Airspace, 1st Edition, Aerospace InsightsRisk management refers to the practice of identifying potential risks in advance, analysing them and taking precautionary steps to reduce or avoid them. Any entity making an investment decision exposes itself to a number of financial risks. Aviation is particularly vulnerable due to the capital-intensive nature of the industry. Aviation insurance is one of the tools to manage these risks. The first aviation insurance policy was written by Lloyd’s of London in 1911. The Warsaw Convention of 1929 established terms, conditions and limitations of liability for carriage by air and provided the first recognition of the modern airline industry.

The aviation industry has faced numerous challenges in recent times, such as the Asian financial crisis, the watershed terrorist attacks of September 11 2001, SARS, and high fuel prices. More recently the Covid-19 pandemic has exerted unprecedented challenges to the industry, from which it is yet to recover. These events with roots in economic, public health, and political triggers have caused severe financial losses to the industry. Aviation risks are very complex and costly and are usually shared by several insurers within a specific aviation insurance market.

The catastrophic nature of aviation insurance can be measured in the number of losses that have cost insurers hundreds of millions of dollars. No single insurer has the resources to retain a risk the size of a major airline, or even a substantial proportion of such a risk. This course introduces you to the concepts of aviation risks, insurance and liability, and provides you with the tools to ascertain liability exposure.

Purpose of the course

To introduce learners to the concepts of aviation risks, insurance and liability.

Objective of the course

1. To equip the learners with the skills of managing risks in aviation operations.

2. To provide learners with skills of evaluating risks and providing mitigating factors.

3. To enable the learners determine applicable insurance premiums

4. To train the learners on how to ascertain the liability exposure to airlines and manufactures of aircraft.

Expected learning outcomes

On completion of this course students should be able to:

1. Manage risks in aviation operations.

2. Evaluate risks and provide mitigating factors.

3. Determine applicable insurance premiums

4. Ascertain the liability exposure to airlines and manufactures of aircraft.

Introduction to Quality Management, Basic concepts of Quality, Historical Background, Quality in Goods, Quality in Services, Measuring Quality, Total Quality Management, Quality Standards and Certification, ISO 9000 Quality Management System, Quality Assurance Concepts, Industry Specific Standards. Quality in Aviation; Quality and Safety, Human Factors, The Quality Manager, Quality Systems in Aviation. Service Performance; The Service Management System, Service Management Techniques, Service Blue Printing. Resource Panning; Resource Allocation Techniques, Resource Allocation in Aviation, Output Maximization, Operations Planning.

This course introduces you to Space Science. It provides all the background knowledge required to understand the requirements for development of space vehicles.

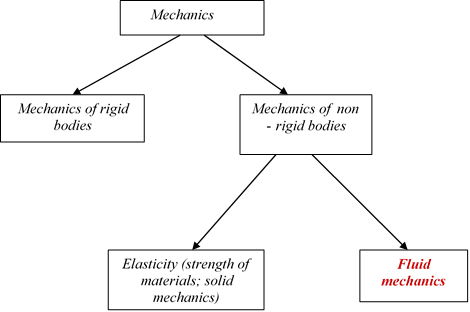

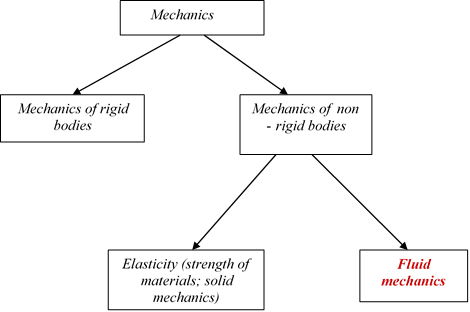

Mechanics is a branch of applied mathematics dealing with

motion of matter and tendencies to motion. This includes the special

case in which a body is under the action of several forces but

remains at rest.

The study of fluids is of fundamental importance since our immediate environment including the atmosphere and oceans are all fluids. Most living things include huge amounts of fluid in their bodies. Mechanical engineers use fluid mechanics to design the various fluid machines like turbines, pumps, compressors etc. Brake systems, automatic transmission and power steering in automobiles are just some examples of the use of fluids. The design of engines, including the internal combustion engines used in cars require a good knowledge of fluid mechanics. Civil engineers study fluids so as to effectively design dams, weirs, canals etc. Aerospace engineering is concerned with the motion of aircraft, missiles etc. in air, while electrical engineers are interested in the use of turbines in power generation. Magneto-hydrodynamics (MHD) is concerned with the interaction of electrically conducting fluids and electromagnetic fields.

Purpose of the course

This is the first course in Fluid Mechanics for Engineering students.

The purpose of the course is to introduce the basic principles of Fluid Mechanics and relate these to applications in Engineering.

Objectives of the course

To provide learners with an understanding of the methods used in study of Fluids.

To equip the learners with an understanding of the basic properties of fluids

To enable the learners understand the principles of Mechanics to the motion of fluids

To enable the learners understand and relate the motion of fluids to the problems of engineering.

Expected learning outcomes

On completion of this course students should be able to:

solve basic problems in fluid mechanics

apply the principles of fluid mechanics to design basic engineering systems

use available computational tools to solve problems in fluid mechanics

design and evaluate engineering pipe systems

Course Content

Properties of fluids: definitions; fluid statics, hydrostatic pressure; forces and centres of pressure on plane surfaces. Boundary layers; laminar and turbulent flows and velocity profiles. Fluids in motion: concepts of control surface and control volume, steady and unsteady motion, ideal fluids, Euler's equation and one-dimensional steady flow equation. Bernoulli's theorem and applications; pitot tubes, orifices; nozzles; venturimeters, notches; time to empty tanks. Flow through pipes: Reynolds number, fluid friction and head loss.

Learning and Teaching Methodologies

Lectures, class discussions, group work and group presentations.

Course Assessment:

Type |

Weighting |

Continuous Assessment |

40 % |

Examination |

|

Total |

100 % |

Core texts

White, F.M. (2008) Fluid Mechanics McGraw Hill, Seventh Edition

Douglas J. F., Gasiorek J. M., Swaffield J. A, Jack L. B. (2005) Fluid Mechanics Pearson Fifth Edition

Supplementary texts

Batchelor G. K. An Introduction to Fluid Dynamics. Cambridge University Press

Massey B. S. (2006) Mechanics of Fluids Taylor & Francis, Eighth Edition

Tutorials

Douglas J. F. Solving Problems in Fluid Mechanics Vol I. Longman Technical & Scientific

Odido D. O. Tutorial Problems

The purpose of this module is to introduce you to the application of Computational Fluid Dynamics in the solution of problems in Engineering and Science. The course covers applications of numerical techniques in Fluids and Heat Transfer. It covers historical background, theoretical considerations, solution algorithms and application. Real-life examples are provided and solved. You will work on a Capstone Project so as to apply the skills that have been introduced.